Last Friday, the Centers for Medicare & Medicaid Services (CMS) released the highly anticipated final regulations implementing the Medicare Access and CHIP Reauthorization Act (MACRA). MACRA creates two value driven ways of interacting with CMS: Advanced Alternative Payment Models (AAPMs) and the Merit-Based Incentive Payment System (MIPS). Here is what you need to know about each. CMS listened to and responded to a vast array of comments from health care stakeholders. I believe the rule will move the country to where doctors are reimbursed for quality and value not volume. In creating a clear path for small, independent physicians to embrace the transition to value, CMS makes it possible for leading independent practices to reduce costs, boost outcomes, and thrive.

Advanced Alternative Payment Models: What You Need to Know

Most commonly taking the form of accountable care organizations and bundled payment initiatives, the defining characteristic that make an alternate payment model “advanced” is risk. Risk is usually simply defined as poor performance means I will have to write CMS a check. The critical question was how big does the check have to be to qualify. CMS originally proposed that the check had to be a percentage of the denominator in the model so in an ACO a percentage of total cost of care or in bundles a percentage of the total bundle price. Yet as we detailed in blog posts (here, here and here) as well as in our formal comments to the proposed rule this would have disadvantages smaller, physician-led groups that represent only a small percentage of the total cost of care.

Therefore, we are very pleased to see CMS simplify how they measure the amount of risk and relate it to the financial resources of those participating in the APM entity. CMS recognizes that not all APM entities have the same financial resources so it is impossible to use the same standard for all and claim that the risk is merely more than nominal for all of them.

CMS finalized for 2017 and 2018 that risk representing 8 percent of the Medicare Part A and Part B revenue received by participants of the ACO or other APM would qualify the APM as advanced. CMS also indicated that this could ramp up over time to as much as 15 percent in later years. This would ensure that participation in an AAPM always entails more risk than participation in MIPS, a goal we support.

Advanced Alternative Payment Models: What to Watch For

This is just the first step. Today no two-sided risk APM takes advantage of this motivational level of risk. CMS indicates in it regulation that updates to existing APMs are coming very quickly. In particular CMS talks about a MSSP Track 1+ that would take advantage of this lower risk track in time for physicians to be in it for 2018 which would affect their payments in 2020. We look forward to seeing CMS move quickly to catch their various models up to this final rule.

While not an issue for most ACO participants, physicians should be aware that they must have at least 25% of their Medicare Part B services or at least 20% of their Medicare Part B patients attributed to the APM to individually qualify for the 5% bonus payment. Nearly every primary care physician in an ACO model will easily push past these thresholds, but specialists and physicians in other models should be wary of this provision especially as it ramps up to 50% and 35% respectively in 2021 (reporting year 2019) and all the way to 75 and 50% in 2023 (reporting year 2021).

Medicare Incentive Payment System: Need to Know

CMS recognized that with 2017 starting in just two and a half months and calls 2017 what it was always going to be: a transition year. To successfully navigate the transition year there are two number to know: 3 and 70. 3 is how many points you need in 2017 to avoid any penalty in 2019. 70 is how many points you need to gain access to the $500 million exceptional performance bonus pool that Congress created.

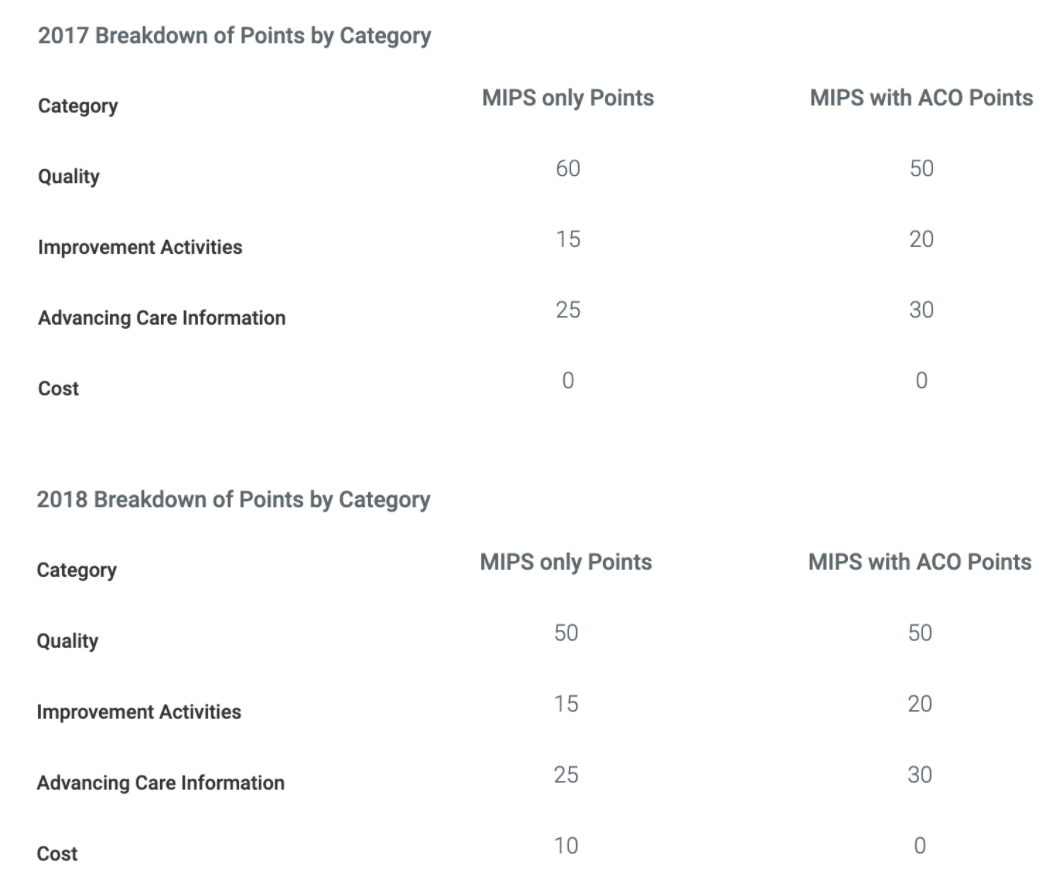

MIPS is divided into four categories that total up to 100 possible points.

To get the 3 points you need only successfully report one measure for one category. This prevents any 2019 negative payment adjustments. A low bar to be sure, but you must interact with CMS in 2017 at least this much or you will receive a negative 4% adjustment in 2019.

Because CMS expects most physicians to at least report one measure, there will not be a lot of positive payment adjustments available under budget neutrality rule. This means most of the positive potential in MIPS is tied to the exceptional performance bonus pool. To access this pool, you must report at least 90 days preferably the whole year and earn at least 70 points. While it appears possible to get there while ignoring one of the categories other than quality this is not advisable. Each category has some built in low hanging fruit (for example you get 50% of the points in Advancing Care Information just for having 5 specific EHR capabilities) that should not be missed. Every organization should look into the three scored categories and plot their best way to get to at least seventy points.

To start you on that path, improvement activities is the easiest category and as mentioned you get 50% of the points in ACI just for fully implementation of your EHR. That is 22.5 points right there in MIPS only and 35 points in MIPS with ACO, certainly a solid base to start from. If you have done PQRS before, if you have done meaningful use before and certainly if you are in an ACO or other “non-advanced” APM then look into how you can be in that exceptional performance pool right away. If those things are new to you then take full advantage of 2017 as a transition year.

Medicare Incentive Payment System: What to Watch For

There are a lot of reporting submission options. Claims, registry, EHR, CMS web interface, CMS wants your data and they will take it however they can get it. If you are in an ACO your ACO quality reporting does double duty. If you aren’t in an ACO or ACO won’t be in its performance year in 2017 then you have to choose which option to use. The first consideration is what options are available to you. Is there a registry for your specialty, are you on an EHR those type of capability question. If you are capable of more than one, the second thing to keep in mind that each has its own benchmarks. So the benchmarks for CMS web interface are the same as the benchmarks used for the Medicare Shared Savings Program whether you are in an ACO or not. The benchmarks for EHR submission are based on past performance of those who submitted through EHR, etc. Benchmarks for most measures are published in advance and could influence your choice of submission method.

Bottom Line:

AAPM – Excellent news on right sized risk, but models that use it will come out in 2017

MIPS – Must minimally interact with MIPS in 2017 to avoid penalty and if you are ready the bonus pool is within reach.