When practices join an accountable care organization (ACO) to help improve the quality of care to their patients, the results are undeniable. In 2022 alone, physician-led ACOs who participated in the Medicare Shared Savings Program (MSSP) earned more than double the average of hospital-led ACOs, pulling in $294 per Medicare beneficiary vs the $140 per beneficiary earned by hospitals.

These results point to the success of physician-led ACOs and the value-based care they bring to their patients. But what actually makes these ACOs successful? And what measures do they have to take to get there?

Let’s take a look at 3 key performance areas that indicate whether or not an ACO is performing well. These will help you evaluate if your current MSSP partner is an ACO you want to stay with long-term, or help you decide if joining an ACO is the right step for your primary care organization.

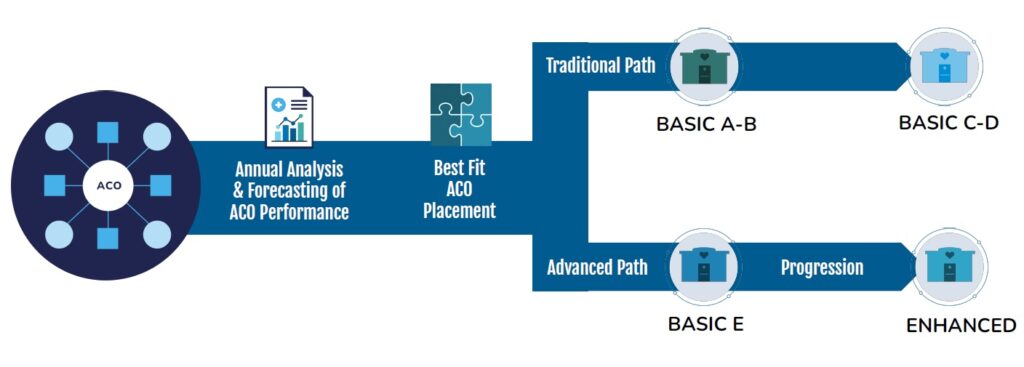

1. Track selection and portfolio management

No matter how well practices deliver value-based care, simply participating in the MSSP program isn’t enough. Primary care organizations have to join an ACO that both places them in the right track and prioritizes portfolio management. Otherwise, they risk missing out on maximized shared savings revenue.

Great ACOs use their data to find the best track fit for each practice, allowing the ACO to confidently take on more risk, for more reward. Practices should be placed in a track with an appropriate risk level to match their value-based care readiness and experience.

For example, if your practice is successful in your value-based care work, you could potentially be in an enhanced ACO track, where good performance is rewarded at higher rates. Essentially, practices should look for an MSSP partner that can help them move over to the enhanced track infrastructure successfully so that their return is maximized.

Additionally, great ACOs continually interpret their results in the context of their overall size and scope. For example, a practice who has been in an ACO for several years but only received a couple of shared savings checks should question whether or not their ACO partner is monitoring its performance, track selections, and risk across its entire portfolio of practices.

Overall, the larger portfolio an ACO has, the better able it is to match practices with optimal peers so that everyone succeeds. When looking for an MSSP partner, consider how many ACOs they support, as well as whether or not they will maximize your practice placement.

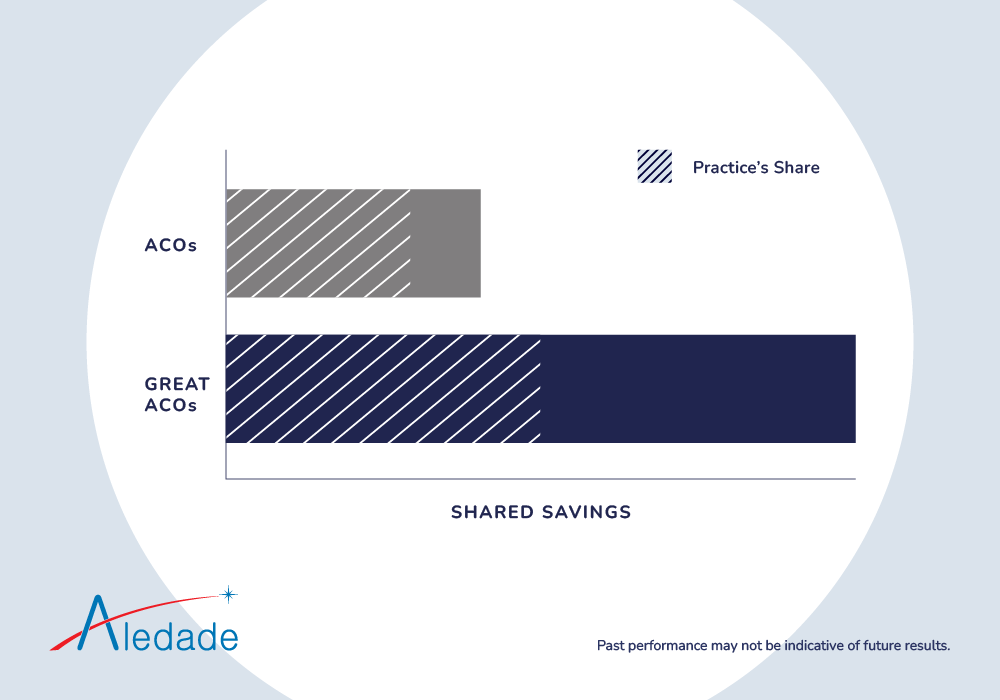

2. Shared savings

If an ACO is on the right track and managing its portfolio well, it stands to reason these actions can result in consistent shared savings, and more often than not, they do. A great ACO will achieve shared savings with year-over-year improvements.

However, despite government-standard performance goals for all ACOs, the way different ACOs share savings with their member practices is not the same, ultimately affecting your bottom line.

Some ACOs can offer a higher portion of smaller savings, meaning you can actually make less than if you had been in a higher-performing ACO that evenly splits savings with their members. Other ACOs could also:

- Have additional fees

- Take a percentage of ownership in your practice

- Fail to protect you from downside risk (which means you could owe your ACO)

When an ACO consistently achieves shared savings and does so with year-over-year improvements, it’s a sign of a strong and sustainable organization.

3. Patient engagement and quality care

Shared savings are a good thing, but you can’t achieve this goal without first meeting ACO quality standards, many of which relate to proactive patient engagement. This includes coordinated value-based care that focuses on preventive services like health screenings, Annual Wellness Visits, chronic disease management, prescription refills and more.

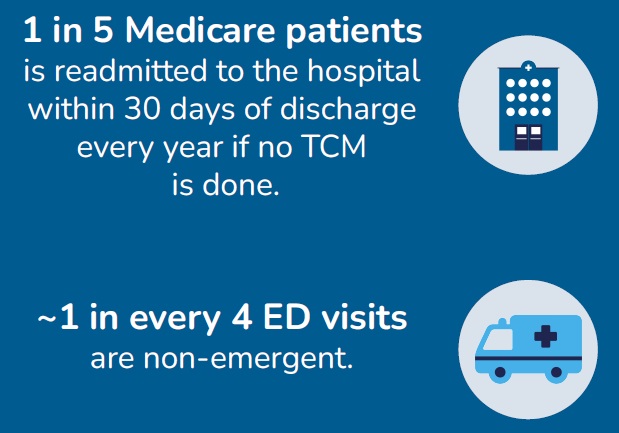

If you’re not receiving the right data and insights from your ACO on your attributed patients, delivering the right care at the right time can be challenging. This can lead to additional issues in managing population health, such as increased hospital discharge and emergency department (ED) utilization.

Every year, nearly 1 in 5 Medicare patients is readmitted to the hospital within 30 days of discharge, with an average cost of $15,500 per readmission. This categorization also includes patients who are dually eligible for Medicare and Medicaid. But the more preventive, primary care you deliver, the more hospitalizations and emergency department visits are avoided. This means that decreasing unnecessary hospitalizations and emergency department visits are crucial ACO performance indicators.

In order to keep patients at the highest level of health possible while lowering costs, you need to engage patients in proactive primary care. A great ACO prioritizes combining patient engagement with primary care services to improve quality of care, therefore reducing costs while earning shared savings.

Successful ACO performance is not solely dependent on any one metric, but on the three key performance areas covered above. Primary organizations should be seeking out the right ACO partner to support them in their transition to/adoption of value-based care to help them achieve their goals.

Choose an ACO partner who can help you with your value-based care goals. Watch our 2022 MSSP results webinar now so you can earn maximum shared savings while delivering better care.